Many mistakes made by new homeowners during the 2008 financial crisis can easily be avoided with a few common sense tips that everyone should know. These tips can be a lifesaver when it comes to acquiring a good mortgage without resorting to heavy borrowings.

Many mistakes made by new homeowners during the 2008 financial crisis can easily be avoided with a few common sense tips that everyone should know. These tips can be a lifesaver when it comes to acquiring a good mortgage without resorting to heavy borrowings.

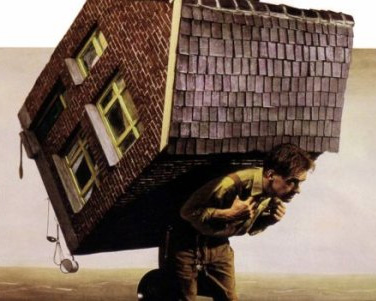

During last decade’s housing bubble, many inexperienced buyers made the mistake of buying a home that was well beyond their means. Just because the bank will sign off on the papers doesn’t mean that it’s a good buy. Buyers nowadays can avoid this problem by limiting their mortgage payments to a quarter of what they earn monthly.

Some buyers don’t actually live in the properties they purchase. Instead, they gamble on the fact that they can sell off their newly purchased home in the future for a profit. Of course, this turned out poorly for those who bought into the housing bubble. New homeowners should bet on the property’s current value instead of hoping that it will increase in the future.

Those with active mortgages can actually lower their monthly rates if they wish to refinance their existing liabilities. This can help a homeowner manage his household finances while still maintaining a good piece of property. In any case, new home buyers should consider their finances first before looking at properties they know they can’t afford.